Cheap International Payments in Denmark: Money Transfers with Wise

It's surprising how many people are still grappling with hefty transfer fees when sending money globally. As someone closely working with clients all over the world, I witness the struggle daily — banks seem to have a knack for imposing exorbitant fees, especially when dealing with different currencies, as is often the case with DKK. While disheartening, it undoubtedly mirrors the complex economic landscape influencing our day-to-day engagements.

Today, I'm excited to unveil a game-changing solution that has personally transformed my financial landscape — Wise, formerly TransferWise. I took the plunge and started using this platform in 2021, shortly after relocating to Denmark. It's safe to say I can't imagine how I managed before. Let's dive into what it offers, its limitations, and why it's my preferred choice for smooth and budget-friendly money transfers.

Table of ContentsShow

Wise — money transfer service which offers 3 products: Wise multi currency account for privates and businesses & Wise platform

What is Wise?

Wise is an online money transfer service, formerly known as TransferWise. It provides a streamlined platform for individuals to transfer money globally. As of 2024, it offers three main products: Wise Account, Wise Business, and Wise Platform.

Which Currencies Does Wise Support?

As of time of writing (2024, January) you can:

Keep 50+ currencies in your Wise account (full list).

Add money to your account (top up your account) in these currencies: AUD, BGN, BRL*, CAD, CNY* CHF, CZK, DKK, EUR, GBP, HUF, IDR*, JPY, MYR*, NOK, NZD, PLN, RON, SEK, SGD, TRY and USD.

Receive money (get “local” bank details): AUD (Australia), CAD (Canada), EUR, GBP (United Kingdom), NZD (New Zealand) , MYR (Malaysia), PLN (Poland), SGD (Singapore), USD (America), RON (Romania), HUF (Hungary), TRY (Turkey).

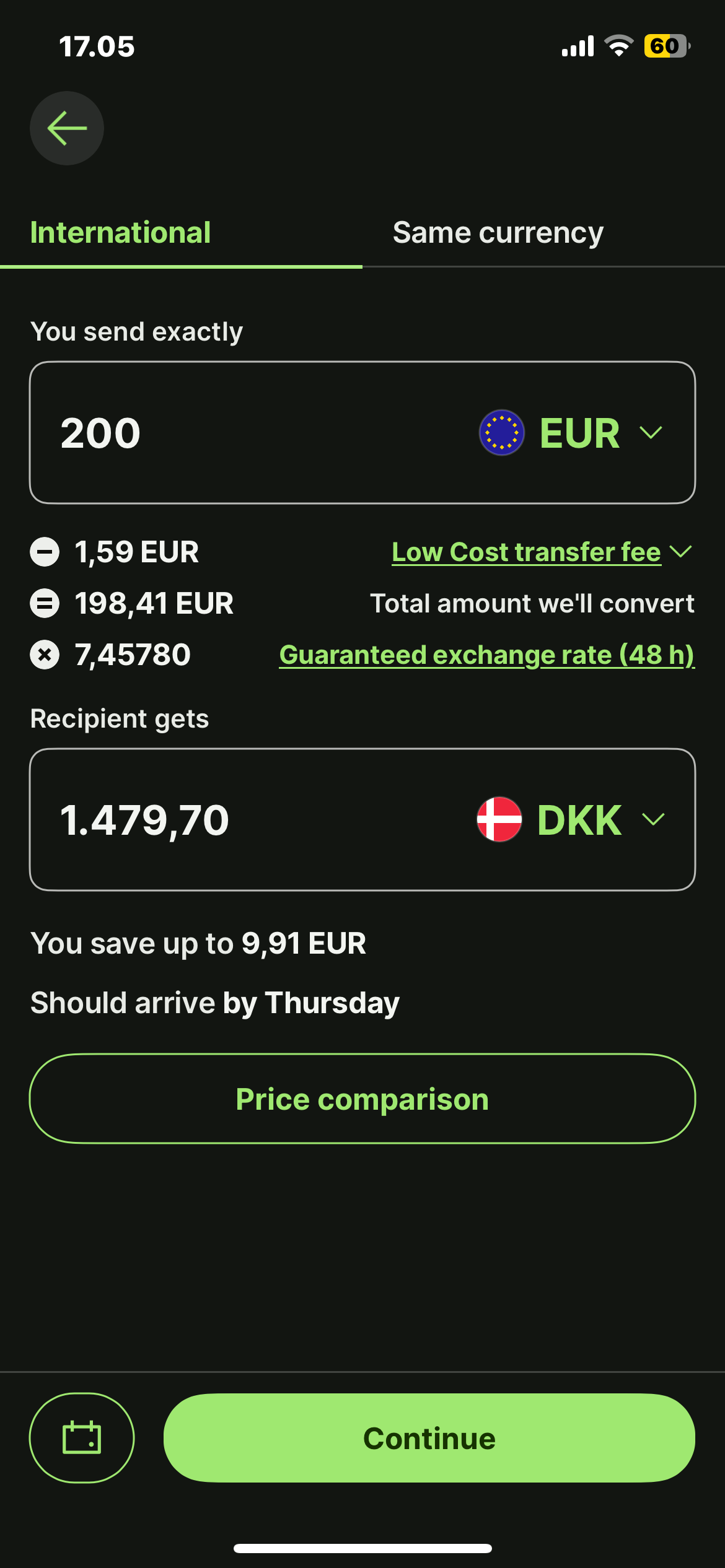

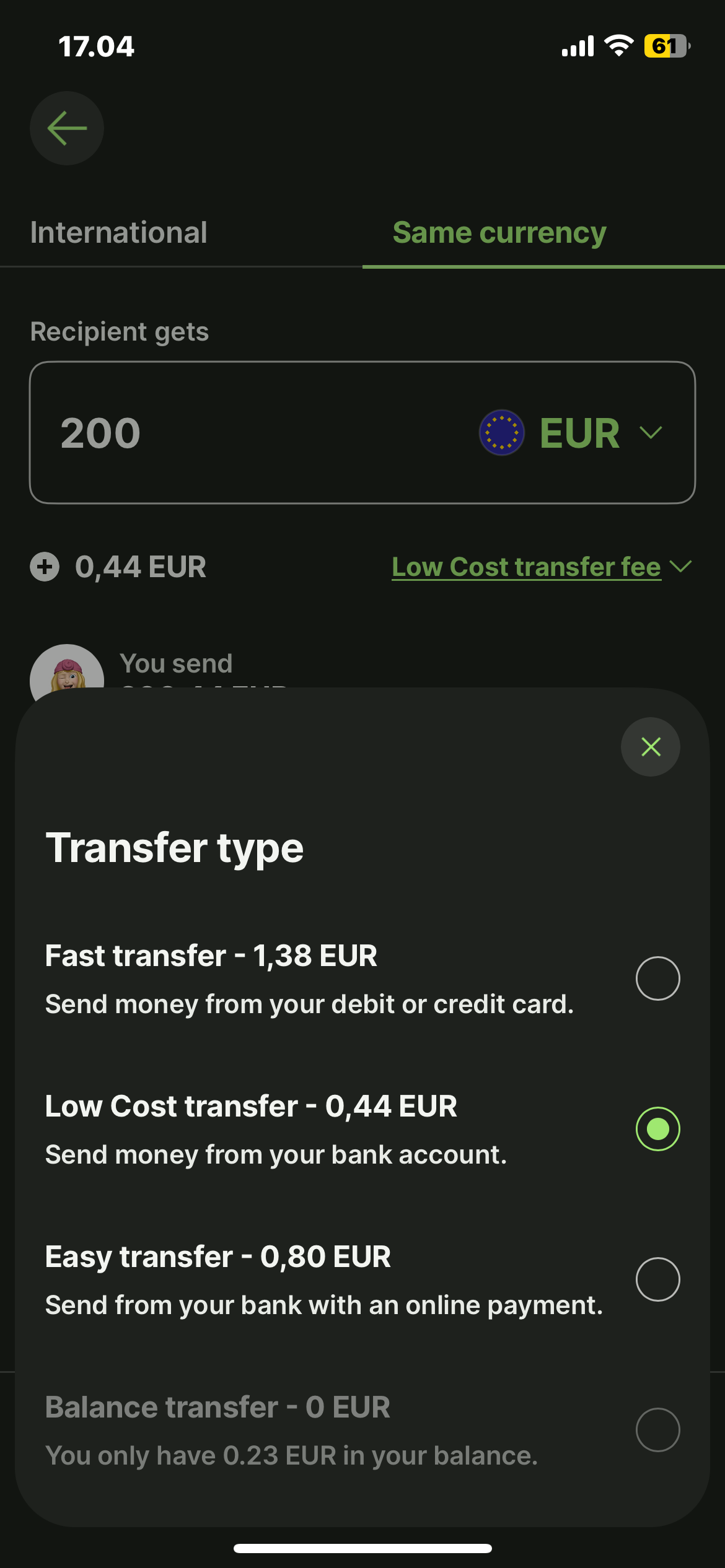

Transferring money in different currency (DKK) vs transferring in EU. Click on photo to enlarge.

Do You Need a Wise Account to Send / Receive Money?

To send money through Wise, you need an account. You can opt for either a low-cost, easy transfer or a fast transfer. If your Wise account holds a balance, the transfer is free of charge.

I recommend my clients to initiate the payment in euros since then the transfer is going to be free (if you hold a balance in your account) or almost free (for a low-cost & easy transfer). If they decide to send in other currency (for example, DKK), the fee is going to be higher. Detailed fee structures can be referenced in the attached images (click on the image to open in full view).

If you wish to receive money, Wise account is not needed.

Why I use Wise Myself?

As mentioned earlier, I decided to open a Wise account shortly after relocating to Denmark primarily due to the different currency. However, what swiftly became apparent were the additional advantages it offered. Notably, when traveling abroad, having a Visa card often proves more advantageous than a Mastercard, and Wise conveniently issues Visa cards. Another aspect I appreciate is the opportunity for monthly cashback, coupled with the consistency of exchange fees regardless of whether it's a weekday or weekend.

It's crucial to emphasise that my experience with the Wise account is entirely on a personal level. I don't have insights into the benefits of Wise business accounts. For my business transactions, I leverage Wise as a payment solution (to receive money).

The limitations of Wise

While Wise is my preferred choice for handling international transactions, it's essential to note its limitations. Compared to other digital banks (like N26 or Revolut), Wise may have slightly lower cash withdrawal limits. Additionally, it may not offer as many perks, such as discounts on accommodations, commonly found with other platforms. Transfer fees for currencies other than euros could be higher compared to alternative platforms.

Bonus: Wise Promo Code

If you're considering significant money transfers, I highly recommend opening a Wise account. It's not only absolutely free, but you also qualify for a complimentary virtual card (though a small fee applies if you prefer a physical card). For more details about Wise, you can find additional information here.

Moreover, upon opening your account, you're eligible for a fee-free transfer up to 4000 DKK (approximately €500) if using this link. Why not to give it a go?

Wise has become an integral part of my financial toolkit. While it's essential to acknowledge its limitations, the overall benefits make it a standout choice. Remember, this article reflects insights from January 2024, so be sure to check Wise's official website for the latest updates.

You may also be interested in the following articles: